From Paper to Digital, Cat Financial transforms its Credit Application

Project completed while employed at vervint

This was a collaboration between myself, blia thor, and tabitha rivera.

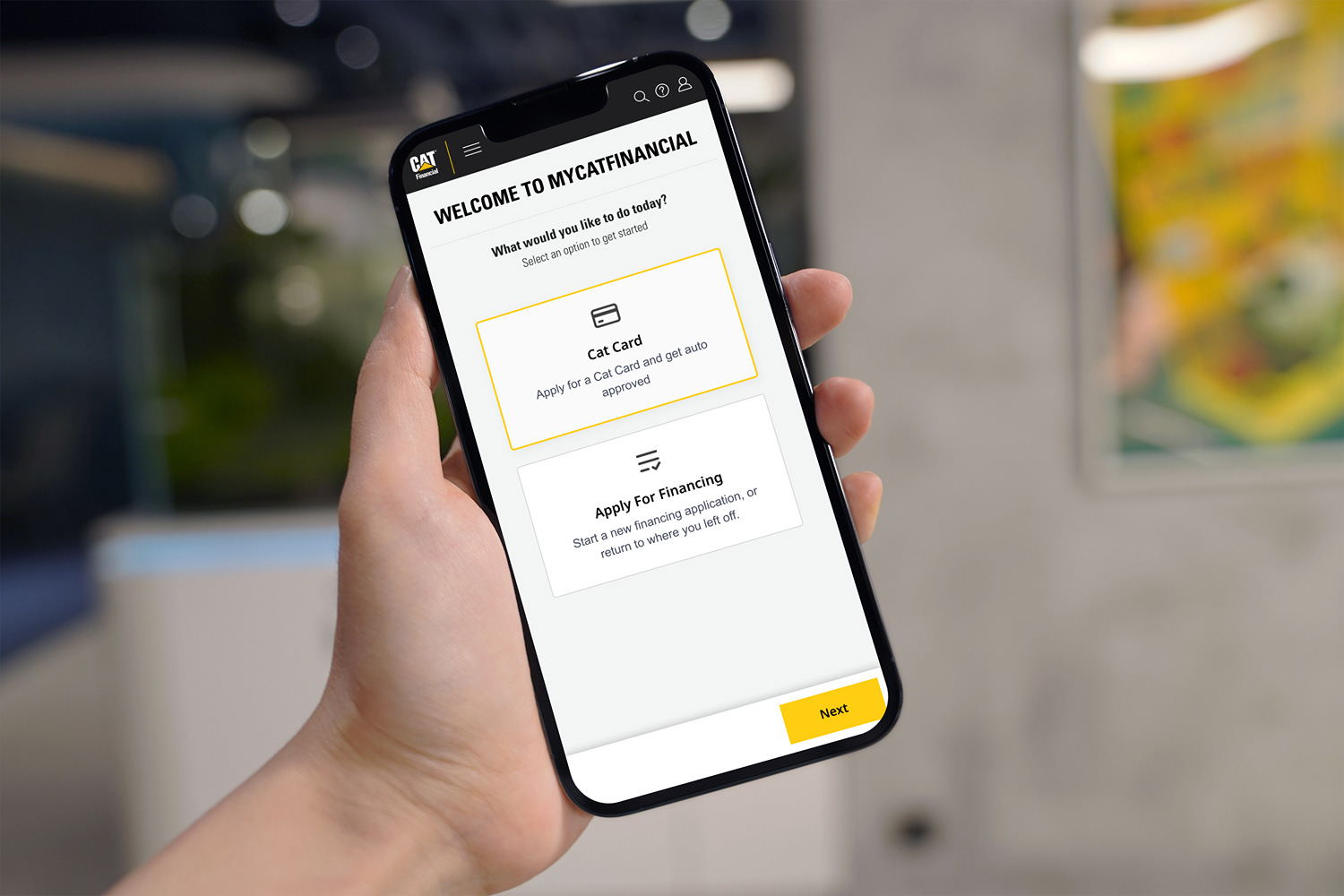

In the ever-evolving world of financial services, ensuring a seamless and user-friendly experience is critical. This case study looks into the challenges faced by Cat Financial, a leading provider of retail and wholesale financing solutions and extended protection products to Caterpillar customers and dealers, whose goal through this process was to enhance the accessibility and completion rates of credit applications.

By partnering with OST and using an iterative and thorough UX design approach, Cat Financial aimed to transform the credit application process while aligning it with its larger goal of digitizing traditional

paper-based operations.

By partnering with OST and using an iterative and thorough UX design approach, Cat Financial aimed to transform the credit application process while aligning it with its larger goal of digitizing traditional

paper-based operations.

The Challenge:

Cat Financial recognized a primary challenge in their credit application process - incomplete paper

applications rendered potentially valuable leads useless. The company was losing out on promising customer leads because they couldn’t process complete forms. They also wanted to shift from paper to digital

operations. So, they had two challenges: making credit applications easier to access and ensuring people

fill out all the required fields.

Cat Financial recognized a primary challenge in their credit application process - incomplete paper

applications rendered potentially valuable leads useless. The company was losing out on promising customer leads because they couldn’t process complete forms. They also wanted to shift from paper to digital

operations. So, they had two challenges: making credit applications easier to access and ensuring people

fill out all the required fields.

In addition to improving the function, we planned to bring a cohesive, unified user experience by introducing Cat Financial to the Cat Digital design system and utilizing their components throughout the new credit application. We facilitated meetings between our Cat Financial and Cat Digital stakeholders and even arranged for a demonstration of the Blocks 3.0 design system so they could experience the breadth of work themselves. Cat Digital developed the design system for use across all digital products at Caterpillar. However, awareness and adoption of the system still needs to be improved. At OST, we see the value of a cohesive design system to benefit users, so we worked to integrate the Blocks system into our project. These engagements sparked excitement and confidence from our Cat Financial partners, knowing that there was robust support for future projects through this design system.

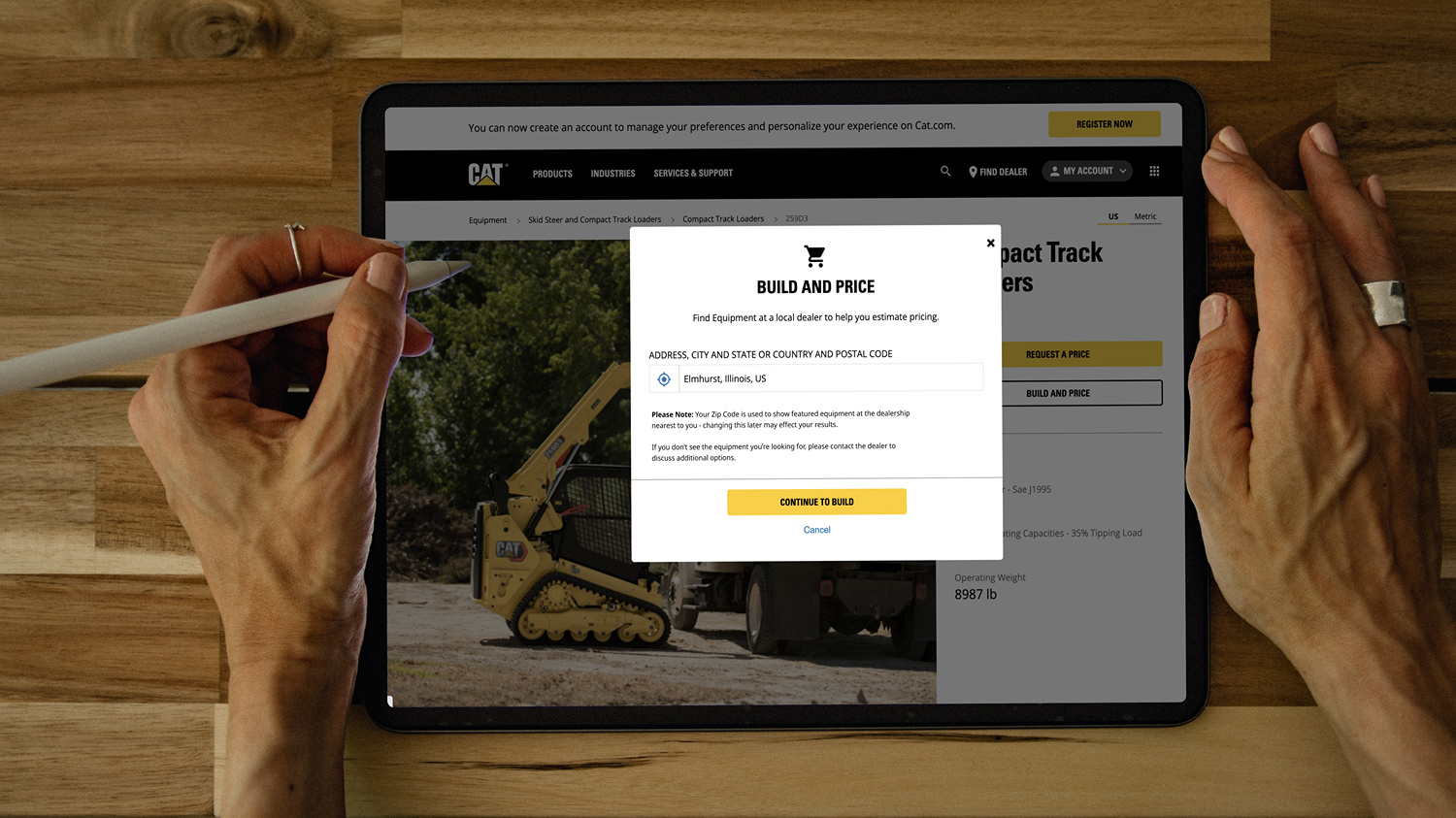

Understanding the diverse needs of its customer base, we helped Cat Financial introduce a novel approach by combining retail and machine financing options into a single, unified application form. This streamlined process not only simplified the user experience but also increased the efficiency of internal operations. Furthermore, Cat Financial stayed flexible with rules, changing the application process to follow Dodd-Frank regulations.

Outcomes and Impact

Cat Financial's commitment to enhancing the user experience and digital

transformation will bear significant fruit in terms of outcomes:

transformation will bear significant fruit in terms of outcomes:

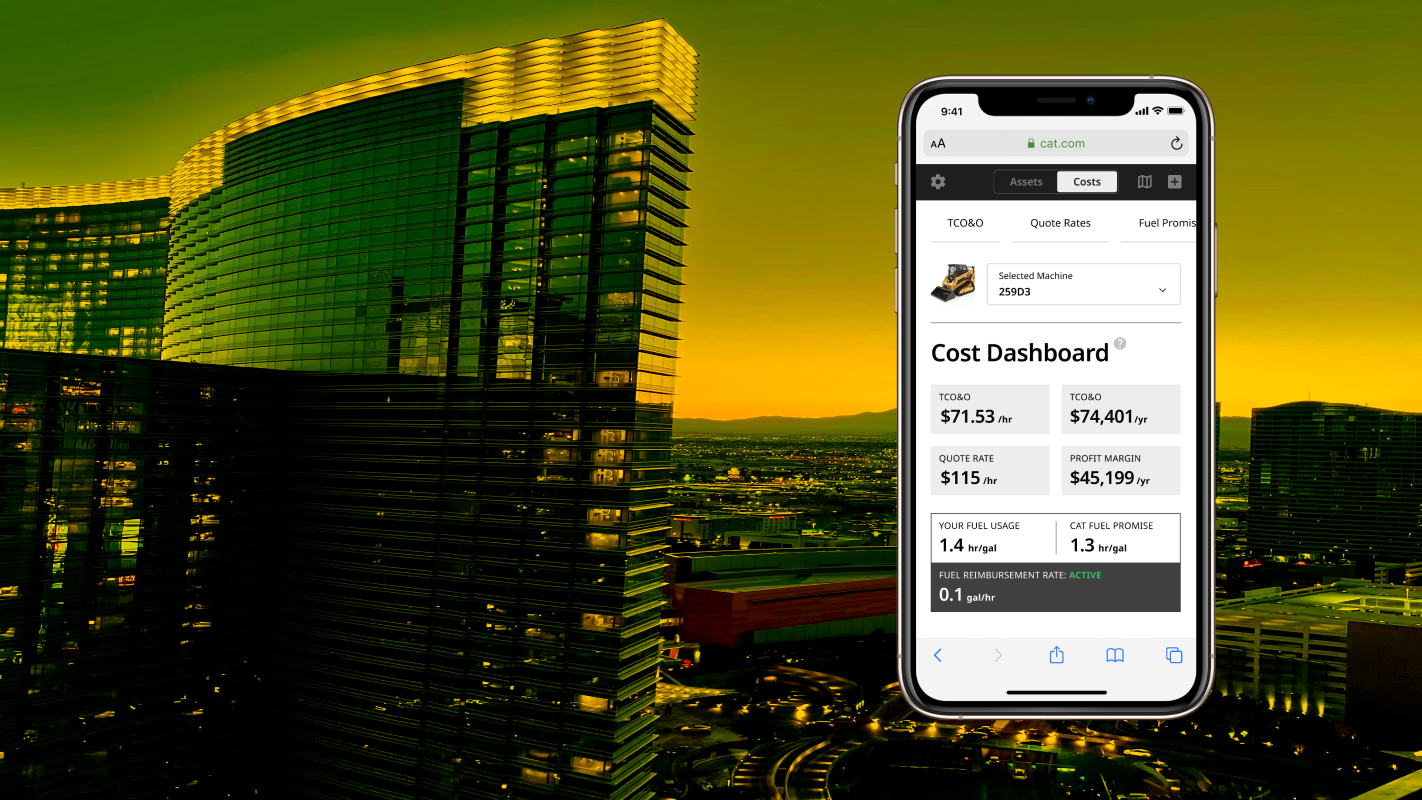

Increased Leads: By making the credit application process more accessible and user-friendly, Cat Financial will likely note increased leads generated. Prospective customers will be more inclined to start and complete the application process, contributing to a broader pool of potential customers.

Higher Completion Rates: The incorporation of real-time field validation within the digital Online Credit Application will lead to a substantial increase in completed applications. With mandatory fields automatically checked, we will prompt applicants to provide all necessary information, reducing incomplete forms.

Streamlined Approval Process: As a direct result of the improved application process, Cat Financial's approval workflow will become more efficient. Completed applications will contain accurate and comprehensive data, speeding the assessment and approval process for Cat Cards and machine financing.

Adaptability to Regulatory Changes: Cat Financial's commitment to iterative design will allow it to integrate changes required by Dodd-Frank regulatory updates. This flexibility ensures compliance while maintaining a user-centric application process.

Enhanced Customer Satisfaction: Applicants will appreciate the straightforward nature of the digital application, which will reflect positively on the brand and foster trust.

Cat Financial's transformation from old-fashioned paper applications to a super-smooth, intuitive process is like a thrilling adventure in improving customers' machine financing lives. With innovation, flexibility, and a focus on users, Cat Financial is on the path to making credit accessible, efficient, and digital.

This journey proves just how vital UX design is, making things run smoother and keeping customers happy and loyal along the way!